CT JD-CV-3 2023-2025 free printable template

Get, Create, Make and Sign ct wage execution form

How to edit ct proceedings online

Uncompromising security for your PDF editing and eSignature needs

CT JD-CV-3 Form Versions

Understanding the Wage Execution Proceedings Application Form

Understanding wage execution proceedings

Wage execution is a legal process employed by creditors to recover debts directly from a debtor's wages. This procedure allows a creditor to request a court action to withhold a portion of a debtor's salary, effectively ensuring that owed amounts are paid off over time. The significance of wage execution proceedings lies in their ability to provide creditors with a reliable method of recovering debts while also giving debtors a structured repayment plan.

Wage execution proceedings are governed by laws that vary by jurisdiction, establishing the protocols for how creditors can initiate these actions and the rights of the debtors. An understanding of the legal framework is crucial for all parties involved, as it dictates the conduct of wage executions and the obligations of both creditors and employers.

Key terminology in wage execution

To navigate the landscape of wage execution, familiarity with essential terminology is important. Key terms include:

While most people are familiar with these terms, misconceptions can arise. For instance, the belief that garnishment can take all of a debtor’s wages is incorrect; laws typically limit the amount that can be withheld.

Eligibility for wage execution

Eligibility to initiate wage execution requires certain criteria to be met. Generally, a creditor must have a legally enforceable judgment indicating that the debtor owes them a specific amount. Additionally, only debts that are considered collectible can warrant wage execution.

Individuals or business entities that have provided goods or services to the debtor can file for wage execution as long as a court judgement exists. Before proceeding, creditors should also consider the debtor's current employment status and potential defenses they may raise to contest the garnishment.

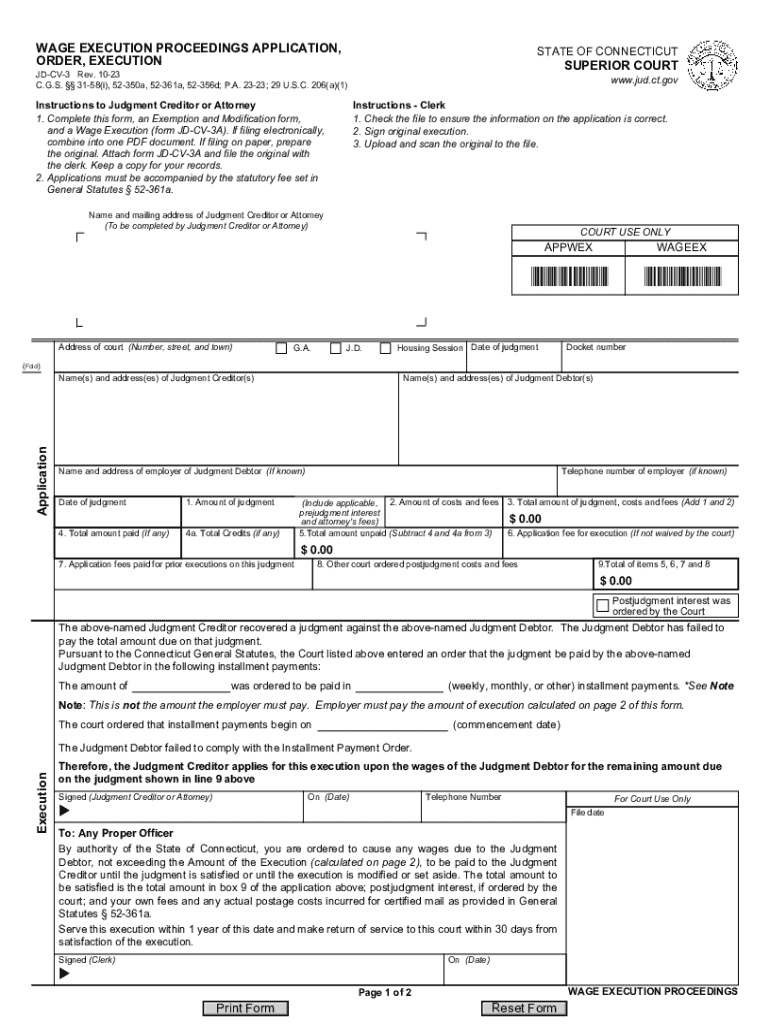

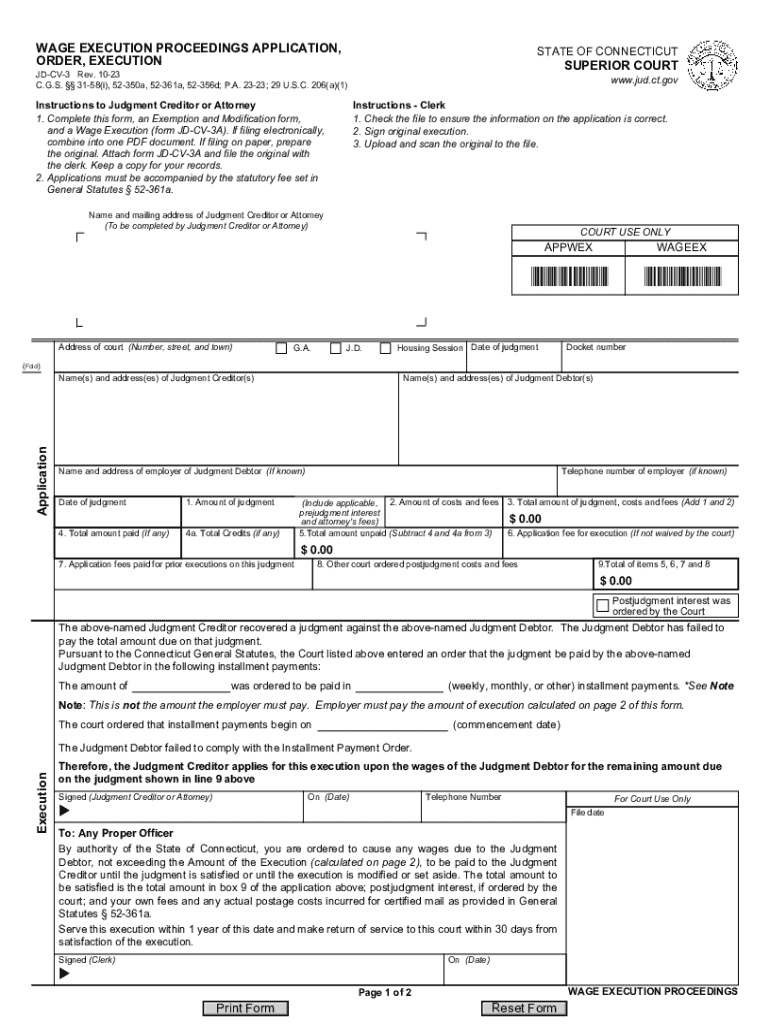

Overview of the wage execution proceedings application form

The wage execution proceedings application form is a critical document that facilitates the initiation of the garnishment process. Properly filling out this form can significantly impact the outcome of the proceedings. A complete and accurate application is necessary for the courts to process the garnishment request effectively, ensuring compliance with legal requirements.

The form typically includes key elements such as the creditor's details, debtor's information, the amount owed, and relevant court references. It is essential to ensure that all fields are filled in correctly to avoid delays or dismissals.

Step-by-step guide to filling out the application form

Filling out the wage execution proceedings application form requires attention to detail and accuracy. Here’s a step-by-step guide:

Review and submission process

Before submitting the wage execution proceedings application form, a thorough review is essential. Ensure all required sections are filled accurately, and double-check for any missing attachments that could hinder the process.

Once you confirm everything is in order, you will need to submit the application to the appropriate court. Depending on jurisdiction, filing fees may apply, so it’s wise to be prepared for these additional costs.

After submission: what to expect

Once the application has been submitted, creditors need to be aware of the estimated timeline for wage execution proceedings. The processing times can vary significantly based on the court's workload and the specifics of the case.

Creditors will be notified of any decisions made by the court, and it is vital to remain responsive to any further instructions or clarification requests.

Understanding employer responsibilities

Employers play a pivotal role in wage execution proceedings. Upon receiving a writ of garnishment, employers are legally obligated to withhold the specified amount from the debtor's wages and remit this directly to the creditor as per the court's instructions.

Challenges and common issues in wage execution

Both employers and debtors often face challenges during wage execution proceedings. Common defenses raised could involve disputing the validity of the debt or errors in the execution process. Debtors may contest an increase in garnishment amounts or assert that the garnishment violates state limits.

To proactively address potential disputes, it's essential that creditors maintain all documentation and communication regarding the debt. Understanding the process for appeal or contesting a garnishment can also prepare both parties for any legal proceedings that may arise.

Additional considerations

Navigating the world of wage execution proceedings can be complex. Various resources are available for legal assistance, including pro bono legal services or online legal advice platforms that can provide clarity on unfamiliar terms or processes.

Conclusion: embracing efficient document management

The apparatus of wage execution proceedings can be daunting; however, efficient document management tools can simplify this process. Platforms like pdfFiller empower users to seamlessly edit PDFs, eSign documents, and collaborate with ease. By utilizing a cloud-based solution, individuals and teams can access templates and forms for wage execution, streamlining their experiences while ensuring compliance.

Embracing such technologies not only enhances efficiency but also fosters clarity throughout the wage execution process, providing peace of mind for all parties involved.

Video instructions and help with filling out and completing ct wage form

Instructions and Help about connecticut execution form

Hello, I’m Scott from Turbo Tax, with important news for taxpayers who have income taxes withheld from their paychecks. When you started your last job, do you remember filling out a W-4 form? It may have been one of many documents you had to complete for your employer, but because you can update it at any time, you may want to think about submitting a new one. As an employee, the IRS usually requires your employer to withhold income taxes from each paycheck you receive. Your employer will not use an arbitrary percentage to withhold; instead, it’s based on your expected annual compensation and the information you provide on a W-4 form. The main objective of withholding is to insure you pay enough taxes during the year to cover most, if not all, of your tax bill by December 31— nothing more, nothing less. Estimating your tax bill with such precision before the year is over may seem impossible, but if you prepare your W-4 using information from your recent tax returns, and nothing else significantly changes, you can get pretty close. The W-4 form uses a system of allowances that0are used to calculate the correct amount of tax to withhold. The more allowances you report on the W-4, the less tax will be withheld—meaning more money in your pocket every time you get paid. But, to avoid under withholding, you should only claim allowances for items you will be reporting on your tax return. For example, the W-4 allows you to take one allowance for your personal exemption and an additional one for each dependent you anticipate claiming on your tax return. You can also increase your allowances for other reasons such as working only one job or being the sole earner of your family if married. And if you usually use the head of household filing status, you can report an additional allowance for that as well. Other allowances are available for some tax credits you will take and for reporting itemized deductions. Essentially, each allowance represents some form of reduction to your estimated taxable income for the year. And the calculations used to determine your withholding reflects these reductions. Generally speaking, you get a tax refund when you claim too few allowances, because more tax was withheld during the year than you actually owed. When you claim too many allowances on your W-4, you could end up owing taxes at tax time. If you’d like to see exactly how different numbers of allowances affect both your paycheck and your refund, try our W-4 Calculator. Just go to TurboTax.com and click on the “Tax CalculatoranticspquTotooquoquTotoot; For more information about this and other tax topics visit TurboTax.com.

People Also Ask about connecticut execution

Why is CV called resume?

What is the form of CV?

How is a CV different than a resume?

How do I write a CV form?

Is A CV the same as a resume?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify connecticut execution application without leaving Google Drive?

Where do I find ct execution form?

Can I create an eSignature for the execution application form in Gmail?

What is wage execution proceedings application?

Who is required to file wage execution proceedings application?

How to fill out wage execution proceedings application?

What is the purpose of wage execution proceedings application?

What information must be reported on wage execution proceedings application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.